Income is the name of the game

Download as PDF

Channel Islands Property Fund (CIPF) has proved a resilient investment since its launch in 2010 and remains an attractive income-generating investment. Its defensive characteristics were highlighted during the pandemic when 100% of anticipated rent was received throughout the period. This regular and predictable revenue stream allowed it to declare and distribute its ongoing quarterly dividend of 1.65p/share, arguably justifying its 5.3% premium to NAV. It currently yields 6.5%, which is attractive and exceeds the dividend yields available on many other multi-let property investment funds.

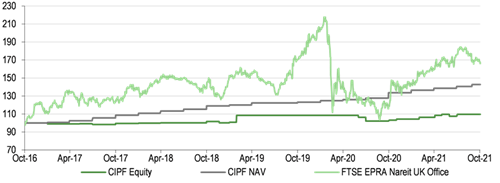

CIPF price, NAV total return and benchmark total return, rebased to 100

Source: Refinitiv, Edison Investment Research. Note: Total returns in sterling.

Attractions of investing in Channel Islands property

Investment in Channel Islands property is attractive for several reasons. Firstly, investment assets on the islands have defensive qualities, which include longer than average leases versus similar assets on the mainland, and the occupiers tend to be resilient finance industry companies with strong covenants. Secondly, during the pandemic, the strength of these covenants was tested. In the event, CIPF collected 100% of anticipated rents. Lastly, yields tend to be c 75bp higher than in comparable regional UK markets, offering scope for Channel Islands’ yields to trend closer to regional levels, suggesting potential for capital uplift. This has seen the pool of global investors widen in recent years.

Ideal income-generating investment

The predictable nature of the rental income stream, long leases and lack of additional office space supply make CIPF a very attractive vehicle for investors looking for regular income. The long-term total return has been in line with the benchmark, although it has lagged in the last 12 months as share prices elsewhere have recovered, but CIPF has remained relatively stable throughout.

Predictable income implies a 6.5% running yield

The fund yields 6.5% at the current share price, which is attractive in its own right and comfortably above the average of 4.7% for peers with similar characteristics. There is potential for dividend growth or capital appreciation, but the current yield is the main attraction. The ongoing charge figure (OCF) is in line with its peer group at 1.94%. There are no performance fees chargeable.

NOT INTENDED FOR PERSONS IN THE EEA

Market outlook: Pandemic highlights robust CI market

The outlook for the Channel Islands in terms of investment activity is encouraging as the world begins to come out of lockdown; CIPF has demonstrated resilience during the pandemic, when all anticipated rents were collected, as well as to the working from home (WFH) trend, albeit this has had less of an impact given minimal commuting times. However, this is not the only reason why this location is attractive. Firstly, investment assets on the islands have defensive qualities, which include longer than average leases (c 15 years) versus similar assets on the mainland (c five years), and because the occupiers tend to be resilient finance industry companies so the strength of their covenant is also high.

Secondly, during the pandemic, the strength of the covenants was tested. In the event, D2 Real Estate (formerly BNP Paribas Real Estate (Jersey)), the fund’s property manager, collected 100% of anticipated rents, underscoring the strength of the covenant. There were no deferrals or incentives granted.

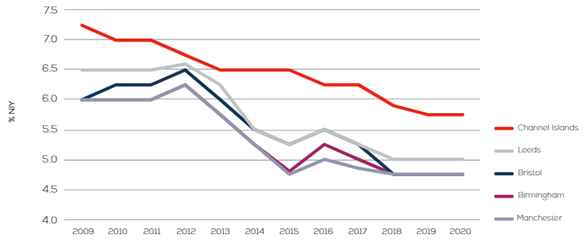

Thirdly, yields tend to be c 75bp higher than for comparable regional UK markets. We believe this is partly due to lower anticipated capital appreciation and partly to a liquidity premium, the idea being that it is harder and takes longer to sell assets in the Channel Islands. In isolation, this yield premium is attractive, but it also offers scope for Channel Islands yields to trend closer to regional levels, which offers potential for capital appreciation. This may happen post the pandemic as investors are beginning to wake up to the idea of investing in the islands. This is evidenced by new investors, including US REITs, beginning to acquire assets there. That said, when the cost of rates is added to the headline rent, the total occupier cost in the Channel Islands is lower than for most large English cities according to research from D2 Real Estate.

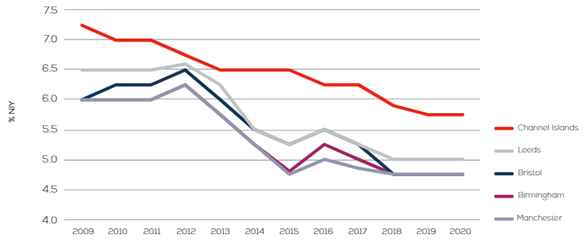

Exhibit 1: Prime yields

Source: D2 Real Estate

In 2020, c £61m of office stock changed hands, less than one-third of the levels in 2018 and 2019, reflecting a lack of availability rather than a lack of demand, and due to the effects of the pandemic. Buyers across the two islands included a listed fund, a syndicate and some private investors.

Demand in 2021 remains strong, with a key client focus on buildings with attractive working environments, which are rated using the Building Research Establishment’s Environment Assessment Method (BREEAM), with occupiers looking for buildings that can deliver on individual ESG initiatives.

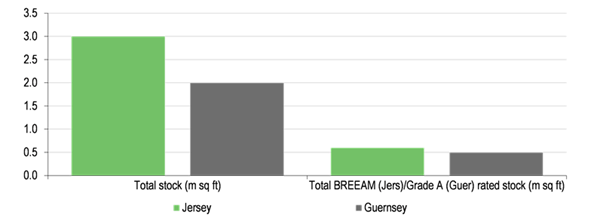

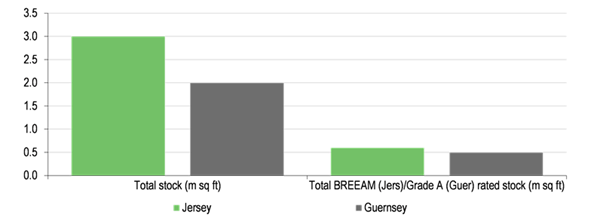

Exhibit 2: Channel Islands occupational market

Source: D2 Real Estate

Jersey’s occupational market

Jersey’s occupational (office) market runs to approximately 3m sq ft, of which CIPF owns c 165,000 sq ft, implying a market share of 5.5%. According to D2 Real Estate (D2RE), as of April 2021 there was approximately 390,000 sq ft of potential space in the pipeline including 140,000 sq ft at the International Finance Centre, 50,000 sq ft at 8/9 Esplanade and 200,000+ sq ft, subject to pre-lets, at J1 St Helier. The potential increase in space amounts to 13%, four times more than is being developed in Guernsey.

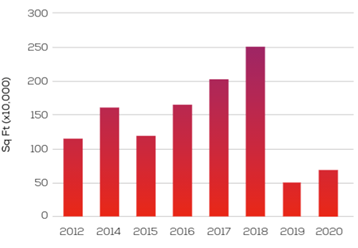

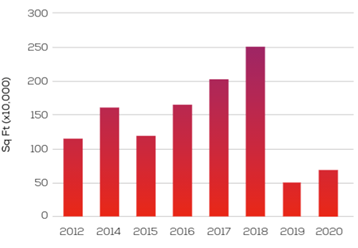

In recent years, demand has matched the level of new development, with the take-up of 200,000 sq ft and 250,000 sq ft in 2017 and 2018 respectively. Since then, take-up has fallen away as the pipeline has been subdued. That said, 2020 did record c 69,000 sq ft of take-up, which was an increase over the 50,000 sq ft of take-up in 2019, a result seen by some as encouraging given the hiatus in the market. According to D2RE, the lower take-up figures reflect a lack of stock rather than a lack of demand.

One notable feature of the market in 2020 was that of re-gears – where some tenants downsized and others expanded – and this has led to the signing of long-term leases with unbroken terms of nine to 15 years being common.

Exhibit 3: Office take-up by year

St Helier St Peter Port

Source: D2 Real Estate. Note: Excludes lease completions that were the result of pre-lets, which have been allocated to the year that the agreement to lease was signed.

Despite good levels of overall demand seen in 2020, the outlook for rents for BREEAM-rated buildings appear to be under some pressure as enquiries have been at subdued levels and the rental rate for prime, second-generation’ space is at around £30/sq ft, a c 25% discount to BREEAM-rated property which has been attracting rents of £39–40/sq ft. Secondary office space is cheaper still at c £20–24/sq ft outside the Esplanade and is attracting attention.

Guernsey’s occupational market

Guernsey’s occupational (office) market runs to approximately 2m sq ft, of which the CIPF owns c 253,000 sq ft, implying a market share of c 13.7%. According to D2RE, as of April 2021 there was approximately 93,000 sq ft of potential space in the pipeline, including Phase 1 (30,000 sq ft) and Phase 2 (55,000 sq ft) at Admiral Park where 24,000 sq ft was pre-let to Julius Baer, and, c 18,000 sq ft at St James’ Place where 14,000 sq ft was pre-let to Grant Thornton. The potential increase in space amounts to c 5%.

Take-up has generally been considerably lower in Guernsey than Jersey because there has been very limited supply of new space, although in 2020 take-up stood at c 57,000 sq ft, roughly in line with the five-year average. Generally speaking, if the product is available, there is a ready market for the space.

Rental rates for prime/BREEAM-rated property in St Peter Port/Guernsey are at similar levels to St Helier/Jersey, although D2RE believes well-appointed space with car parking tends to attract a modest premium to the £39–40/sq ft level. The same is true of good-quality older space, which attracts a rate of c £30–33/sq ft.

Exhibit 4: Rental rates (BREEAM-rated property)

Source: D2 Real Estate

The Isle of Man: Occupational market

The Isle of Man total office stock extends to around 1m sq ft which makes it around one-third the size of Jersey and half the size of Guernsey’s office market by capacity. CIPF owns c 100,000 sq ft, which implies it owns roughly 10% of the market. The main occupiers tend to be those companies operating in insurance, finance and corporate services, as well as gaming and software supplies. Notable occupiers include Barclays, Zurich, Flutter Entertainment and Microgaming Software Systems.

The market is supply-constrained which limits the supply of new Grade A office space, but this has encouraged several owners to refurbish premises in recent years. Average office take-up in good years tends to be in the range of 60,000–90,000 sq ft (ie 6-9% of the total stock). Grade A rents are around £21.50 to £23.50/sq ft which is around 50% lower than rental rates in Jersey and Guernsey and around a third lower than in other regional prime UK cities.

The investment manager: Ravenscroft Specialist Fund Management

The manager’s view

The attractions of the office markets in the Channel Islands have been highlighted and enhanced by the pandemic. First of all, the quality of the covenants has been amplified by the fact that all rent due was collected on time and in full during every period since the start of the pandemic. This is in sharp contrast to other multi-let office landlords, eg CLS Holdings, which saw rent collections of only 87% in Q220. That said, across the board, rent collected from multi-let office property was much higher than in sectors that were affected far harder such as retail and leisure which, in many cases, were closed down completely for long periods.

Secondly, given the modest size of the islands and the restrictive planning rules, the supply of new space is extremely constrained. Tenants therefore tend to be content to renew leases when they come up for renewal and to sign leases of a much longer duration than is likely to be agreed in other financial hubs like London. As discussed below, leases of five to seven years might be normal elsewhere, but on the islands leases of twice this length are not unusual. In Q221, CIPF agreed two rent reviews, both at uplifts to the passing rent. At 12 August, there was 25,426 sq ft of vacant space in two buildings, most of which had been refurbished and was available to rent. This was 4.9% of total floor space, ie CIPF’s occupancy is running at c 95%. CIPF is witnessing good levels of interest in the vacant floors at Royal Bank Place Regency Court and discussions are ongoing.

We are currently aware of only two properties under construction in Guernsey, both being developed by Comprop:

- No 1 The Plaza, Admirals Park, which offers 31,636 sq ft of lettable office space, and

- St James’ Place, which is a high-quality office building totalling 18,386 sq ft.

Comprop has leased 14,000 sq ft of St James’ Place development on a 15+ year lease to Grant Thornton, which gives some indication of the lengths of leases and the implied quality of earnings that this gives landlords and in turn investors. Only one floor remains available.

Thirdly, both Guernsey and Jersey closed their borders and then locked down early on in the pandemic, which meant that spread of the virus was limited and that the number of COVID-19 cases on the islands was low. There have been 78 deaths in Jersey and 19 in the Bailiwick of Guernsey. These firm actions have invited praise for the governors of the islands and enhanced the attractions to corporates.

The increased attractiveness of the islands to both investors and tenants is in part reflected in the falling yields, which were discussed earlier. It is likely that yields could continue to fall as demand is solid and interest rates remain low, thus supporting the valuations of the CIPF portfolio. In recent years, some notable developments have been bought to the market such as Gaspe House (£90m), Trafalgar Court (£55m) and Dorey and Martello Courts (£60m), which have attracted overseas investors. In addition, the islands have attracted some very wealthy residents, who have bought assets of more than £40m, thus improving market liquidity. The attractiveness of the islands is further enhanced by the similarity of commercial property law to UK’s with the exception that the Landlord and Tenant Act 1954 does not apply, which means tenants have no right of renewal at lease expiry.

As mentioned earlier, the Channel Islands were less affected by the pandemic and a majority of employees within tenant organisations having already returned to the office environment. This situation was noted/underpinned by a major survey undertaken by D2RE in which 85% of all companies surveyed gave the importance of the office to efficiency, collaboration and training a score of 4 out of 5. This has led to greater investment in premises, which insulates the offices from WFH culture and led to long leases on pre-lets and new developments being agreed at the height of the pandemic.

CIPF will continue to monitor the market and assess the opportunities available within the portfolio to deliver increases in shareholder value that fit with the investment guidelines and, ultimately, enhance the dividend for shareholders.

Portfolio positioning

CIPF’s current property portfolio consists of 12 properties – five in Guernsey, four in Jersey and three in the Isle of Man. All are Grade A office properties, often multi-let to internationally well-known financial, legal, technology and shipping companies. This spread of tenants ensures that risks to rental income are lower, as does the long-term nature of the leases, which collectively had a weighted average unexpired lease term (WAULT) of 12.7 years at the end July 2021. This long-term visibility gives investors confidence that the fund will be able to pay its expected future dividends, which is one of the fund’s major attractions.

CIPF’s underlying property portfolio is relatively well spread between the three islands of Guernsey, Jersey and the Isle of Man, with two-thirds located in Guernsey, and a quarter located in Jersey. This is a modest improvement on 2019 as the fund bought 18–22 Grenville Street in Jersey, which had a value of £19m at 31 March 2021, and the more modest-sized Oak House in Guernsey, which had a value of £8.2m, thus shifting the weighting of the portfolio.

The Isle of Man has remained at c 12–13% of the portfolio.

Exhibit 5: Portfolio geographic exposure by capital value – October 2020 vs October 2019

| Region |

October 2020 |

October 2019 |

Change (pp) |

| Guernsey |

63% |

68% |

-5.5 |

| Jersey |

25% |

19% |

6.0 |

| Isle of Man |

12% |

13% |

-0.5 |

| |

100% |

100% |

- |

Source: Channel Islands Property Fund, Edison Investment Research

That said, the yields achieved in the Isle of Man are a lot higher than those achieved elsewhere in the portfolio, so the rental exposure is a little more balanced than the capital value. Guernsey accounts for 58% of contracted rent, Jersey 27% and the Isle of Man 15%.

Exhibit 6: Portfolio by location, value and area

| Property |

Location |

Capital value (£m) |

Contracted rent (£m) |

Gross yield |

Area (sq ft) |

% of total space |

WAULT (yrs) |

Purchased |

| |

|

31 July 21 |

31 July 21 |

(%) |

|

|

31 July 21 |

|

| Regency Court |

Guernsey |

37.6 |

2.3 |

6.06% |

59,996 |

11.60% |

6.7 |

Nov '10 |

| Glategny Court |

Guernsey |

46.3 |

2.9 |

6.52% |

61,606 |

11.90% |

14.4 |

Aug '14 |

| Royal Chambers |

Guernsey |

51.6 |

3.4 |

7.29% |

73,050 |

14.10% |

14.3 |

Sept '17 |

| Royal Bank Place |

Guernsey |

27 |

1.3 |

4.73% |

43,861 |

8.50% |

11.4 |

Jun '19 |

| Valley House |

Guernsey |

8.2 |

0.5 |

6.77% |

14,782 |

2.90% |

13.5 |

Jul '20 |

| |

|

170.8 |

10.4 |

- |

253,295 |

49.00% |

- |

|

| 17-18 Esplanade |

Jersey |

11.7 |

0.9 |

7.42% |

29,241 |

5.70% |

24.3 |

Jul '20 |

| Liberation House |

Jersey |

36.8 |

2.8 |

7.66% |

62,398 |

12.10% |

8.9 |

Sep '16 |

| Windward House* |

Jersey |

- |

- |

- |

24,081 |

4.70% |

- |

Sep '16 |

| 18-22 Grenville Street |

Jersey |

19 |

1.2 |

6.32% |

48,970 |

9.50% |

13.5 |

Sep '20 |

| |

|

67.5 |

4.8 |

- |

164,690 |

31.80% |

- |

|

| Fort Anne |

Isle of Man |

13.9 |

1 |

7.42% |

45,989 |

8.90% |

16.1 |

Aug '16 |

| Vicarage House |

Isle of Man |

11.8 |

0.8 |

7.09% |

30,000 |

5.80% |

10.8 |

May '17 |

| First Names House |

Isle of Man |

7.1 |

0.5 |

7.82% |

23,462 |

4.50% |

16.9 |

Jun '17 |

| |

|

32.8 |

2.3 |

- |

99,451 |

19.20% |

- |

|

| Total |

|

271.1 |

17.6 |

6.66% |

517,436 |

100.00% |

12.7 |

|

Source: Channel Islands Property Fund, Edison Investment Research. Note: *Capital value, contracted rent and gross yield included in Liberation House.

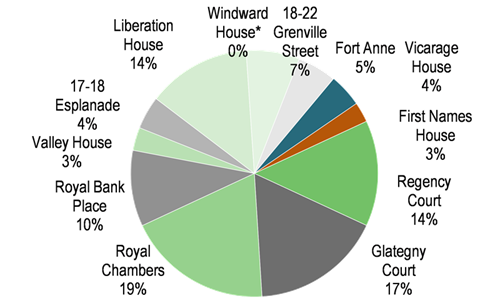

In terms of rental income, the three largest properties in Guernsey – Regency Court, Glategny Court and Royal Chambers – account for just shy of 50% of the total and have an average yield of nearly 7%. Despite the concentration of property represented by these three properties, it is worth describing the range of tenants within the three properties:

- Regency Court: Butterfield Bank (59.2% of contracted rent), Schroders (18.8%) and Deloitte (16.7%).

- Glategny Court: KPMG (26.6%), Collas Crill (26.5%), Investec (23.3%) and Guernsey Financial Services Commission (23.6%).

- Royal Chambers: Mourant (39.7%), Ernst & Young (32.6%), IPES (18.2%) and Terra Firma (9.5%).

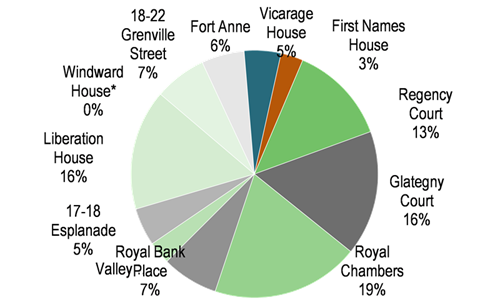

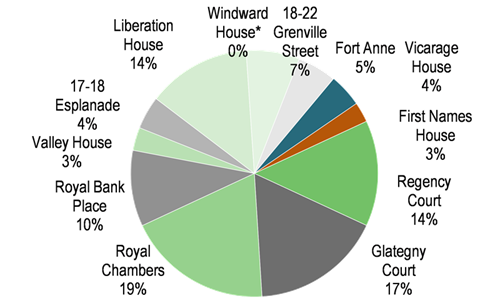

Exhibit 7: Capital value and contracted income by property, at 31 July 2021

Capital value by property as a percentage of portfolio

Contracted rent by property as a percentage of portfolio

Source: Refinitiv, Edison Investment Research. Note: *Windward House capital value and rent is included in Liberation House.

The portfolio includes high-quality covenants and unexpired lease terms of long duration. At 31 July 2021, the whole portfolio had a WAULT of 12.7 years, which is very long for a multi-let office portfolio. We believe a WAULT of around five years is more typical (for example, CLS Holdings’ WAULT is currently 4.7 years).

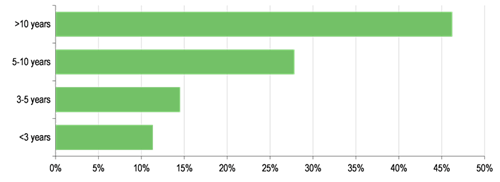

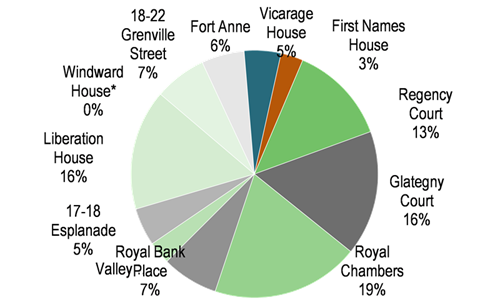

Within this long WAULT, 46% of contracted rent has a WAULT of 10 years or more, and another c 28% has a WAULT of five to 10 years. Only around a quarter of contracted rents have a WAULT of less than the five-year average, and only around 8% have a WAULT of less than three years. However, we do not see the shorter-term agreements as a risk, considering the lack of new space coming onto the market, and the attractiveness of the locations implies a steady stream of interested occupiers.

Exhibit 8: Portfolio by WAULT (% of contracted rent) at 31 July 2021

Source: Channel Islands Property Fund, Edison Investment Research

The tenants in the portfolio are mostly blue-chip financial and legal firms and, as such, can be considered good-quality covenants. The largest tenant by total rental income is the legal firm Mourant, which has offices in many offshore locations including Guernsey, Jersey, the Cayman Islands and the British Virgin Islands.

Exhibit 9: Tenant exposure by revenue as at 31 July 2021

| Tenant |

Sector |

Total rent (£m) |

% of rental income |

| Mourant |

Legal |

2.504 |

14.30% |

| Bank of Butterfield |

Financial |

1.51 |

8.60% |

| Ernst & Young |

Financial |

1.446 |

8.20% |

| CPA Global |

Technology |

0.994 |

5.70% |

| Dohle Shipping |

Transport |

0.986 |

5.60% |

| SG Hambro |

Financial |

0.868 |

4.90% |

| Zurich Insurance |

Financial |

0.842 |

4.80% |

| KPMG |

Financial |

0.75 |

4.30% |

| BDO/Sea Thrift |

Financial |

0.73 |

4.20% |

| Collas Crill |

Legal |

0.692 |

3.90% |

| All other |

- |

6.242 |

35.50% |

| Total |

|

17.564 |

100.00% |

Source: Channel Islands Property Fund, Edison Investment Research

Other leading tenants are the Bank of Butterfield, which has offices in the Channel Islands, Bermuda, the Cayman Islands, the Bahamas, Singapore and elsewhere, and accountancy firm Ernst & Young, which has a global presence. Collectively, these three clients account for more than 30% of CIPF’s contracted rent.

Exhibit 10: Portfolio by % of contracted rent at 31 July 2021

Source: Channel Islands Property Fund, Edison Investment Research

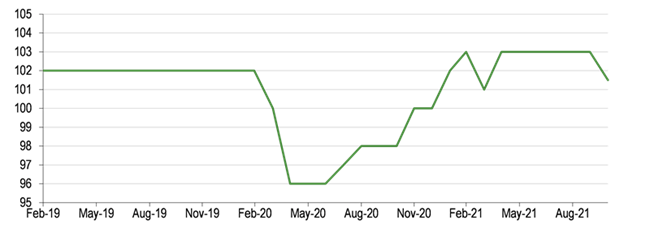

Performance: Remarkably stable over the long term

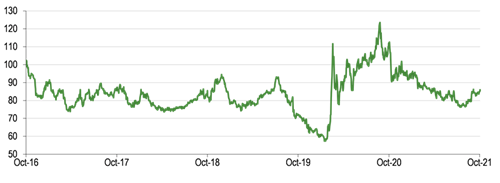

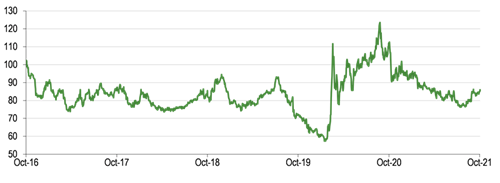

CIPF’s share price has been remarkably stable for most of the 11 years since it listed in 2010 at 100p. It has hovered around the listing price for most of the period, dipping briefly in December 2014 to 97p, and increasing to 104p in May 2017. We believe this stability is driven primarily by the fund paying away most of its earnings as dividends – the trade-off for growth in the underlying assets is a dependable dividend stream.

The long-term stability of the share price also reflects the lack of growth in reported net asset value (NAV). The NAV has been affected by a number of issues including the Brexit referendum result, which hit property valuations that have since struggled to recover, and subsequent valuers’ assessments that reflect forthcoming breaks and expiries as well as potential voids, capex and incentives.

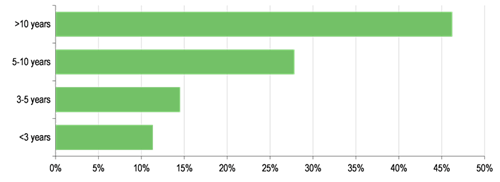

More recently, of course, there has been more volatility, with the share price dipping in March 2020 to 96p as the pandemic took hold. It has since recovered all the lost ground and is now trading at 101.5p.

Exhibit 11: CIPF share price performance over three years

Source: Refinitiv, Edison Investment Research

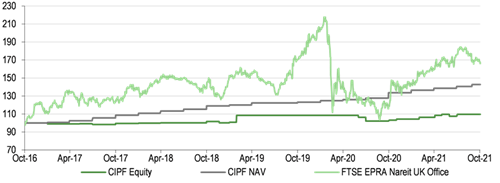

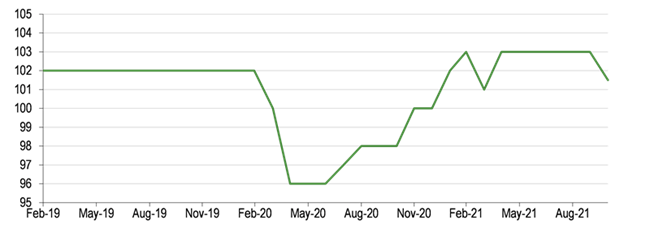

The charts below highlight the longer-term performance of CIPF’s share price in absolute terms, the NAV (including dividends) and the total return of the FTSE EPRA Nareit UK Office Index, all rebased to 100. Again, the share price has been very stable over the extended period, increasing by just 1.8% pa over the last five years, partly because the fund pays out most of the income as dividends, and partly due to liquidity issues, we believe. However, the NAV total return has been better and broadly in line with the benchmark over the longer term. It has increased steadily over the period as the portfolio has generated a steady income stream, and produced a total return of 42.7% over the five-year period to end October, vs the benchmark FTSE EPRA Nareit UK Office Index, which produced a total return of 68.8%.

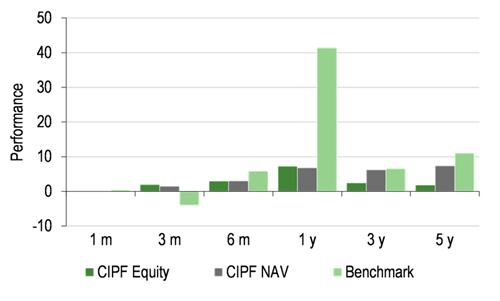

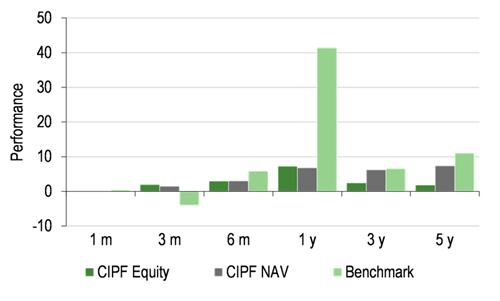

Exhibit 12: Investment trust performance to 21 October 2021

Price, NAV and benchmark total return performance, five-years rebased

Price, NAV and benchmark total return performance (%)

The right-hand chart above highlights the returns over multiple historical time frames. In particular, it shows that the benchmark has performed very strongly over the last 12 months as stock prices have recovered post lockdown. We believe this highlights the volatility of the market versus the stability of portfolio NAV and therefore the attraction of the island property markets.

Exhibit 13 shows the share price and NAV performance versus office and property benchmarks. Over the longer term the share price has lagged, which highlights the potential for some ‘catch-up’ in the future. The NAV has performed better, underperforming the office benchmark by 26.1% over five years, but comfortably outperforming the wider property benchmark by 5.9% over the same period. This is despite capital expenditure of c £6m on three properties over the last three years, including roof repairs and plant replacement at Regency Court, Royal Bank Place and Liberation House. The NAV has also been hampered by a revaluation reduction in 2016 of £6.0m due mainly to Brexit and a further £3.6m in 2017. Dividend payments generally account for the majority of profits thus limiting NAV growth.

The short-term underperformance of both the share price and the NAV versus the benchmarks reflects the recovery of other markets that were more profoundly affected by the pandemic.

Exhibit 13: Share price and NAV total return performance, relative to indices (%)

| |

One month |

Three months |

Six months |

One year |

Three years |

Five years |

| Price relative to UK office benchmark |

-0.5 |

6 |

-2.9 |

-34.2 |

-13.5 |

-59.3 |

| NAV relative to UK office benchmark |

-0.5 |

5.5 |

-2.9 |

-34.7 |

-1.3 |

-26.1 |

| Price relative to UK property benchmark |

-3.6 |

1.2 |

-6.8 |

-30.8 |

-13.9 |

-27.3 |

| NAV relative to UK property benchmark |

-3.6 |

0.7 |

-6.8 |

-31.2 |

-1.7 |

5.9 |

Source: Refinitiv, Edison Investment Research. Note: Data to end-October, 2021. Geometric calculation.

Exhibit 14 below tracks CIPF’s NAV total return versus the FTSE EPRA Nareit UK Office Index total return, again highlighting the long-term stability of the fund and its total return performance.

Exhibit 14: NAV performance versus benchmark over five years

Peer group comparison

CIPF does not have any direct peers, but we list below a selection of REITs and funds that have similar characteristics, that is, they tend to hold office, commercial or retail property portfolios that have good-quality covenants. CIPF compares well in terms of its one-, three- and five-year NAV TR performance versus the average, ranking fourth over one and three years and second over five years. It also has an above average yield of 6.5%, an annual charge of 1.94% and no performance fee that would eat into the shareholder returns if it existed.

Exhibit 15: Selected peer group as at 1 November 2021*

| % unless stated |

Market cap (£m) |

NAV TR

1 year |

NAV TR

3 year |

NAV TR

5 year |

Discount (ex-par) |

Ongoing charge ex perf fee |

Perf.

fee |

Net gearing (ex par) |

Income-only yield (%) |

| Channel Islands Property |

162.3 |

7.2 |

24.7 |

41.6 |

5.3 |

1.9 |

No |

174 |

6.5 |

| AEW UK REIT Ord |

170.8 |

28.8 |

41 |

76.3 |

-0.2 |

1.4 |

No |

104 |

7.4 |

| Alternative Income REIT Ord |

50 |

2.5 |

0.8 |

|

-8.5 |

2.5 |

No |

90 |

7.5 |

| BMO Commercial Property Trust |

781.7 |

15 |

1.7 |

18.7 |

-21.5 |

1.7 |

No |

127 |

4.1 |

| BMO Real Estate Investments Ord |

204.6 |

20.5 |

16.5 |

42.3 |

-22.4 |

1.2 |

No |

126 |

4.2 |

| Custodian REIT Ord |

401.7 |

12.2 |

10.9 |

34.1 |

-5.6 |

2.5 |

No |

128 |

5.2 |

| Drum Income Plus REIT Ord |

19.1 |

-1.9 |

-14.2 |

-3.2 |

-27.9 |

2.1 |

No |

174 |

6 |

| Ediston Property Investment Co |

164.8 |

9.7 |

-9.4 |

8 |

-12.5 |

1.4 |

No |

132 |

6.4 |

| LXi REIT Ord |

1,017.50 |

17 |

34.6 |

|

10.2 |

0.9 |

No |

26 |

4.1 |

| Regional REIT Ord |

451.3 |

3 |

7.4 |

28.8 |

-8.8 |

4.7 |

Yes |

21 |

7.3 |

| Schroder Real Estate Invest Ord |

245.5 |

8.6 |

-2.5 |

18.9 |

-16.3 |

2.8 |

No |

142 |

4.5 |

| Standard Life Inv. Prop. Inc. Ord |

291.7 |

16.5 |

12.6 |

44.1 |

-16.5 |

2.7 |

No |

119 |

4.9 |

| Supermarket Income REIT Ord |

1,167.10 |

13.2 |

34.1 |

|

11.2 |

1.2 |

No |

127 |

5 |

| UK Commercial Property REIT Ord |

997.9 |

10 |

6.2 |

30.1 |

-14.2 |

1.5 |

No |

102 |

3.4 |

| Value and Indexed Property Inc. Ord |

101.5 |

28.4 |

-0.4 |

9.2 |

-18.4 |

1.6 |

No |

113 |

5.3 |

| Simple average |

415.2 |

12.7 |

10.9 |

29.1 |

-9.7 |

1.9 |

|

114 |

5.4 |

|

|

|

13.2 |

17 |

29.9 |

-5 |

1.7 |

|

99 |

4.7 |

| Rank |

12 |

12 |

4 |

4 |

|

- |

|

2 |

- |

Source: Morningstar, Edison Investment Research. Note: *Performance as at 1 November 2021 based on ex-par NAV. TR = total return. TER = total expense ratio. NAV TR is on a cumulative basis. Net gearing is total assets less cash and equivalents as a percentage of net assets.

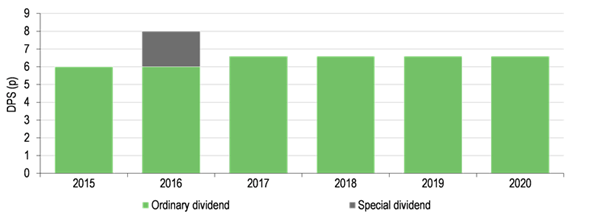

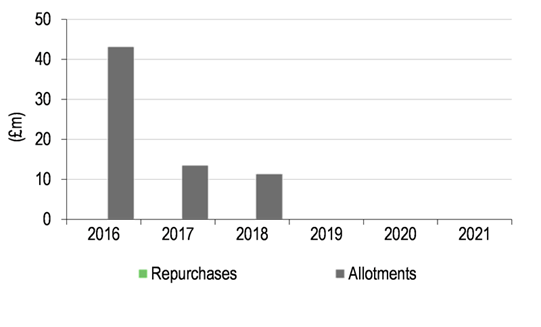

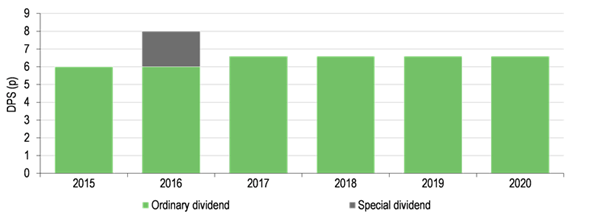

Regular dividends imply a yield of 6.5%

The dividend paid out by CIPF is one of the most important features of the fund. Over the last six years it has consistently paid quarterly dividends to shareholders as the chart below describes. It paid 6p/share in ordinary dividends in both 2015 and 2016, and a total of 6.6p/share in all subsequent periods. It has also continued with quarterly dividends of 1.65p/share declared for Q1 and Q2, which suggests that the total ordinary dividend payments for FY21 are likely to be the same in FY20, ie 6.6p. This implies a dividend yield of 6.5% at the current price.

Exhibit 16 also shows that a special dividend of 2p/share was declared in respect of 2016, again in line with CIPF’s investment objective.

Exhibit 16: Dividend history, last five years

Source: Channel Islands Property Fund, Edison Investment Research

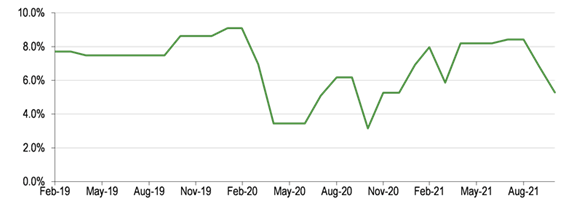

Premium to NAV reflects underlying asset quality

CIPF tends to trade at a premium to its NAV. We believe this is because assets are high quality and the covenants of the tenants are equally elevated. Therefore, the rental income is very predictable and, even in the pandemic, CIPF collected all rent due in every quarter. It follows then that investors value the company on a dividend yield basis.

Currently, CIPF is trading on a yield of 6.5%, which will be attractive to a range of income-seeking investors in the current low interest rate environment and could explain why the shares usually trade at a 3–9% premium to NAV.

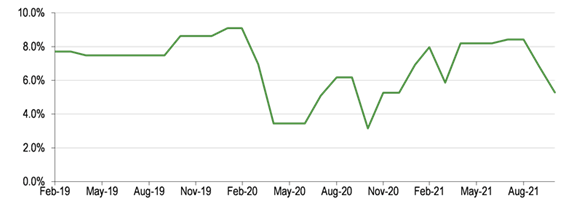

Exhibit 17: Share price premium to NAV

Source: Refinitiv, Edison Investment Research

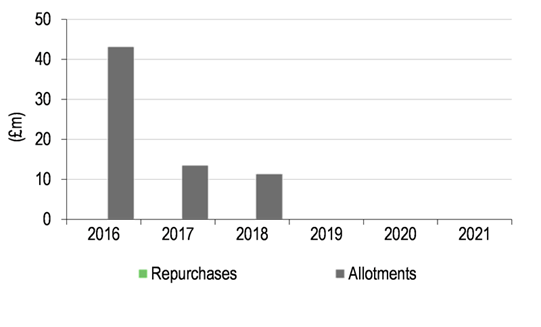

Exhibit 18: Buybacks and issuance

Source: Morningstar, Edison Investment Research

The company has not issued any shares in the last three years but remains open to the potential to do so in the future, should an attractive opportunity arise. CIPF remains focused on developing and improving the existing portfolio to maximise the value and quality of the rental income stream.

Fund profile: The quarterly income is the total return

The company was established in 2010 with the objective of providing an investment opportunity that aims to provide shareholders with a total return from a combination of capital growth and an appropriate dividend policy through the acquisition and active management of commercial property predominantly in the Channel Islands.

The NAV of the fund has tended to fluctuate in a narrow band between c 92p and 96.4p over the last two and a half years, so the total return has mainly consisted of the quarterly dividends that have been declared at 1.65p/share each quarter since the end of the 2016 financial year. On the current price, this implies a yield, and in effect a total return, of c 6.5%.

The company’s investments are not subject to any geographical or other limitations or restrictions. The company may invest directly or indirectly in commercial property including property development as long as no single investment is more than 25% of the portfolio. Investment in property related funds, derivatives and financial indices is also permitted. Leverage is targeted at 40–65% of total acquisition cost.

CIPF’s approach to ESG

CIPF’s board has overall responsibility for its environmental, social and governance (ESG) policy and for delivering on its objectives. The policy applies at all stages of the investment process and to all management activities. Central to CIPF’s ESG strategy is the ambition to achieve carbon neutrality. Day-to-day management is delegated to Ravenscroft as the investment manager, and to D2 Real Estate as the property manager.

CIPF’s ESG objectives are as follows:

- To have a positive effect on the communities in which it operates.

- To be the landlord of choice based on its responsible, sustainable, ethical and transparent approach.

- To mitigate climate change.

- To maintain ethics and integrity in its governance and dealings.

A few examples of how CIPF’s ESG policy is incorporated by D2 Real Estate into the management of the portfolio are given below.

Environmental

- D2RE and CIPF have a commitment to benchmark each buildings’ environmental performance using the Real Estate Environmental Benchmark and subsequently make improvements to multi-let buildings where they fall below the expected performance.

- D2RE and CIPF are facilitating the installation of electric car charging points in the buildings by covering occupiers’ costs incurred in approving and documenting licences for the works, given the disproportionate carbon impact vehicles have in Jersey, Guernsey and Isle of Man. Eight have been installed in 2021 to date.

- Several significant capital expenditure projects have been undertaken, and are planned, which will improve the environmental performance of buildings. For example, the replacement of the building management system in 2021 in a building, which allows occupiers to control the air conditioning within their premises, rather than centrally, which will mean more efficient usage.

- All hard services contracts require suppliers to work to industry best practice SFG20 to ensure optimal efficiency of kit that can reduce consumption by up to 15%.

Social

- Utilising the buildings to support charitable initiatives such as the International Day of Persons with Disabilities by working with EY to light up Liberation House and Royal Chambers in purple to raise awareness.

- D2RE has put in place a Cinema Discount Scheme for all staff within multi occupied buildings in Jersey, which provides a saving of up to 30%.

- Allowing occupiers use of the shared areas in buildings, such as receptions, for their own charitable initiatives.

Governance

- D2RE is a RICS registered company, and so it is bound to run all service charges in accordance with the RICS ‘Service Charges in Commercial Property professional statement’ and strictly do so for the multi-let buildings.

- D2RE adopts a responsible and ethical approach to preventing and detecting financial crime. D2RE considers its obligations in all business conduct and standards for combating financial crime, which includes surpassing the regulatory requirements by employing a specialist independent regulatory advisory business to assist with this.

Gearing: Slowly reducing towards the 40% target

CIPF targets a gearing level of 40% debt to market value, and it has been making progress towards this. In October 2020, the ratio stood at 46.16%, and it fell to 43.72% by April 2021. In September, CIPF agreed a new floating facility with RBSI for six years at slightly improved rates.

This may be subject to an arrangement that will effectively fix the rate to reduce the risk of rising interest rates. The target ratio is well below the covenant level of less than 55%. There are a number of other covenant tests relating to the banking facilities and CIPF remains well within all of them.

Fees and charges: Average OCF and simple structure

The fund has an ongoing change figure (OCF) of 1.94% of NAV. The OCF covers the costs of investment management, administration and other fees for custodians, trustees, regulators and auditors for example. For historical reasons it does not have a performance fee. The only other income is a modest service charge that is recoverable from tenants.

Very simple capital structure

CIPF was established in 2010 as a closed-ended collective investment scheme authorised by the Guernsey Financial Services Commission. It has a single class of share, of which there are now 159.9m shares in issue. Its biggest shareholder is Huntress (CI) Nominees, which holds 85.2% of the issued share capital. Huntress (CI) Nominees is the vehicle through which the clients of Ravenscroft (CI) Limited holds stock in CIPF. We understand that within Huntress there are 704 shareholders, none of which hold more than 10% of the share capital.

Exhibit 19: Shareholders as at 4 June 2021

| Name |

Holding (m) |

% |

| Huntress (CI) Nominees |

136.3 |

85.20% |

| State Street Nominees |

8 |

5.00% |

| Pershing Nominees |

4.8 |

3.00% |

| Security Services Nominees |

3 |

1.90% |

| SBS Nominees |

1.6 |

1.00% |

| BNY Nominees |

2.3 |

1.40% |

| Vestra Wealth (Jersey) |

1.3 |

0.80% |

| Other |

2.6 |

1.60% |

| Total |

159.9 |

100% |

Source: Channel Islands Property Fund, Edison Investment Research

The board

The board of CIPF consists of Chairman Shelagh Mason and three directors, being Steve Le Page, Paul Le Marquand and Paul Turner.

Shelagh Mason is a solicitor specialising in English commercial property. She is the non-executive chairman of Riverside Capital PCC; a board member of Skipton International, a Guernsey licenced bank; and a non-executive director of The Renewables Infrastructure Fund, a FTSE 250 company, the Ruffer Investment Company and Starwood European Real Estate Finance.

Steve Le Page is a chartered accountant and chartered tax advisor and was a partner with PricewaterhouseCoopers for nearly 20 years until his retirement in 2013. He now sits on the boards of a number of funds as chairman of the audit committee in each case. Paul Le Marquand is a chartered surveyor and was head of property management at Heathrow Airport until 2001. Since then, he has been heavily involved with the establishment, operation and administration of offshore property funds and holding structures working with Mourant International Financial Services and Sanne Group. Finally, Paul Turner has extensive experience at the operating and board levels of real estate companies in the UK, the Channel Islands and South Africa, and in the manufacturing sector.

Exhibit 20: Channel Islands Property Fund’s board of directors

| Board member |

Date of appointment |

Remuneration in FY (£) |

Shareholdings at end-FY20 |

| Shelagh Mason |

14 October 2010 |

55,000 |

63,500 |

| Steve Le Page |

1 April 2017 |

40,500 |

100,000 |

| Paul Le Marquand |

1 December 2018 |

34,500 |

- |

| Paul Turner |

1 April 2019 |

34,500 |

- |

Source: Channel Islands Property Fund report and accounts 2020.